What’s So Special about Special Use Valuation? A Chronicle of Current Use

In Alabama, farm or timber landowners can use a particular method to calculate their property’s value for the purposes of taxation. This special use valuation usually results in an appraisal that’s lower than the traditional market value.

While not mandated, this valuation can help lower a landowner’s payment to the government.

Alabama is not unique in this approach. All states have now adopted laws that tax agricultural land differently than other land in an effort to lower the amount of property taxes farmers pay. Motivations vary by state, but in general, these policies help preserve agricultural land, keeping it in production even as urbanization spreads to more historically rural areas.

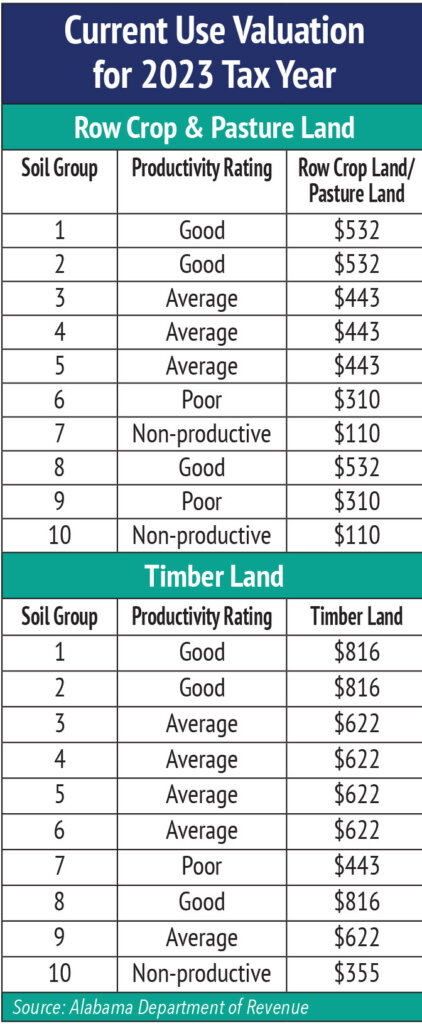

Alabama offers the current use methodology for property that qualifies as agricultural or forest land. This legislation passed in 1978 and was amended in 1982 thanks to grassroots efforts from the Alabama Farmers Federation. The legislation provides a calculation which includes inputs from interest capitalization rates; the top three crops produced in Alabama; and the cost of production or the average price of pulpwood (for timber land calculations). This information is re-calculated every year with updated information from the U.S. Department of Agriculture and the Farm Credit Bank of Texas, which services Alabama.

Ala. Code § 40-7-25.1 defines agricultural and forest property as: “All real property used for raising, harvesting and selling crops or for the feeding, breeding, management, raising, sale of, or the production of livestock, including beef cattle, sheep, swine, horses, ponies, mules, poultry, fur-bearing animals, honeybees and fish, or for dairying and the sale of dairy products, or for the growing and sale of timber and forest products, or any other agricultural or horticultural use or animal husbandry and any combination thereof.”

Owners of forest or timber land who use the current use valuation instead of the market value method must apply with their county revenue assessment official before Oct. 1. If approved, the valuation can then be applied when completing the previous calendar year’s taxes.

The Department of Revenue maintains a general application form counties may use. Counties can also develop forms in accordance with Department of Revenue guidelines. The application must include a description of the property, its use and other information the tax official may require to determine the use.

Additionally, if the property seeking current use valuation is less than 5 acres, the Department of Revenue is authorized to request even more information to ensure the property is actually being used for an agricultural purpose. Once an application has been made and approved, re-application is not necessary.

To learn more about current use valuation, visit www.revenue.alabama.gov.

Compiled by John Allen Nichols, Alabama Farmers Federation Agriculture Counsel.

The material presented above is for educational purposes only. The content does not constitute legal advice. If readers require specific advice or services, a lawyer or other professional should be consulted.